MBA Banking and Taxation Distance Education 2024: The MBA Banking and Taxation Distance Education program is a 2-year PG course. This course provides students with knowledge and expertise in the banking and accounting fields. The eligibility criteria require students must have a graduation degree with a 50% mark. Depending on the university, the course fee ranges between INR 48,910 and INR 86,941.

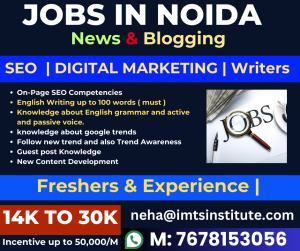

There is an online or offline admission process for this course. The deadline for submitting the admission form is 31 March 2024. This course is offered by the IMTS Institute, Subharti University, and NIILM University, among others.

There are many job opportunities after completing this course in areas such as Financial Management and Rural Banking, Retail Banking, Bank Marketing, and Tax Management. There is a salary range between INR 4 LPA and INR 12 LPA for these job roles. Interested students can call 9210989898 for advice and detailed information about the course, admission process, and career prospects.

MBA Banking and Taxation Distance Education Admission Latest Update (March 2024):

- IMTS Institute has begun the admission process for MBA Banking and Taxation in Distance Mode for the 2024 academic year. The deadline to apply for admission is 31 March 2024. APPLY NOW

- Admission to Subharti University’s MBA program in Banking and Taxation at DDE starts for the academic year 2024. The admission deadline is 29 March 2024.

- MBA Banking and Taxation admission at NIILM University is now available via distance education. The deadline for admission to this university is 27 March 2024.

MBA Banking and Taxation Distance Education Highlights

| Duration | 2 Years |

| Eligibility | Graduation |

| Type | Online or Distance |

| Level | PG Course |

| Admission Process | Online or Offline |

| Fees | INR 48,910-INR 86,941 (approximately As per University) |

Latest Distance Education Universities 2024

MBA Banking and Taxation Distance Education Admission 2024

- The candidates can apply for admission to the MBA Banking and Taxation course at Jayoti Vidyapeeth Women’s University.

- The applicants can apply for admission to the MBA Banking and Taxation course at Alliance University.

- The students can apply for the MBA Banking and Taxation course at MIT World Peace University.

MBA Banking and Taxation DDE Eligibility Criteria

A candidate with a bachelor’s degree with above 50% marks from a recognized university can apply for this program.

MBA Banking and Taxation Distance Education Admission Process 2024

Interested candidates can apply for admission to the MBA Banking and Taxation ODL program by visiting the official site of the university. After visiting, you need to find the admission section where you can fill out the admission form. Fill out all the mandatory details here and pay the application fee. Finally, submit the admission form.

Required Documents for MBA Banking And Taxation Distance Education Admission

- BBA Transcript.

- ID Card

- Domicile

- Passport Size Photos

MBA Banking And Taxation Distance Education Top Colleges in India

The Top universities and colleges are providing MBA Banking and Taxation Distance learning. The candidates can check the names of top MBA Banking And Taxation Colleges in India;

- Jayoti Vidyapeeth Women’s University

- Chitkara University

- Symbiosis International University

- Maharishi University of Information Technology

Institute in Banking & Finance for MBA Banking And Taxation Distance Education Admission 2024

Institute in Banking & Finance begins admission for the MBA specialized program. Admission to the MBA PG degree program will be given to candidates who have passed a UG degree with an entrance test qualification. MBA candidates will need to pass university or national-level exams like CAT/CMAT/MAT.

The minimum qualification required for admission to the Institute in Banking and Finance program is 50%. The enrollment link shall soon expire for the respective MBA specialized degree program. MBA banking and taxation subjects are driven by communication management, practices for banking, principles, financial management, advanced technology, marketing information systems, mutual funds, portfolio management, and more.

What is MBA Banking And Taxation Distance Education?

It deals with business management, marketing, and the economy. Those who want to study under this program should have 50% marks in their bachelor’s degree. Having a command of the English language also enhances the management skills of a candidate and their decision-making power. It covers a broad range of topics like innovation, marketing, entrepreneurship, etc. This is the subject of enhancing candidates’ abilities.

Is MBA Banking And Taxation Distance Education Worth It?

Studying these programs helps the candidate make a career in his life. Its scope is in business, banking, management of any small or large-scale organization, lecturership, budget making, and school. budget and availing of the opportunity for the betterment of the institution.

- Time-saving: As there is no physical travel for studying, this will save time for the candidate.

- Career Making: It has a broad scope in business and management, so it helps the candidate make a better career.

- Good Learning: Online classes help in better learning because candidates have been provided with all the content for studying.

- Flexibility: The candidate can study when he wants to study. It depends on his mood.

- Easy Entry: Candidates who want to study in this program could get easy entry and choice of subjects online. It is also straightforward that candidates have been provided with all terms and conditions for admission and provided with eligibility criteria.

MBA Banking And Taxation Distance Education Career Options

There are many job opportunities and job roles available for people with an MBA in banking and taxes that can be studied online. Companies with a good reputation, like KPMG, HDFC, SBI, Morgan Stanley, Goldman Sachs, Barclay’s, and others, offer jobs in banking and financial services. These highly sought-after companies are always looking for people with experience in MBA banking and taxation distance education because they offer great pay.

MBA Banking And Taxation Distance Education FAQ

Question 1: Is it possible to earn my MBA in Finance through online coursework?

Answer: The following institutions offer MBA programs that can be completed online:

- Amity University

- National Institute of Business Management

- Venkateshwara Open University

- ITM University

- Symbiosis Institute of Distance Learning

- Karnataka State Open University

- Jaipur National University

- Pondicherry University

Question 2: Who is eligible to pursue an MBA in Finance, and what are the requirements?

Answer: Any graduate who has earned a minimum of 50% of their possible points from a recognized board is qualified to apply for an MBA in Finance. On the other hand, seniors are eligible to apply as well.

Be the first to leave a review.